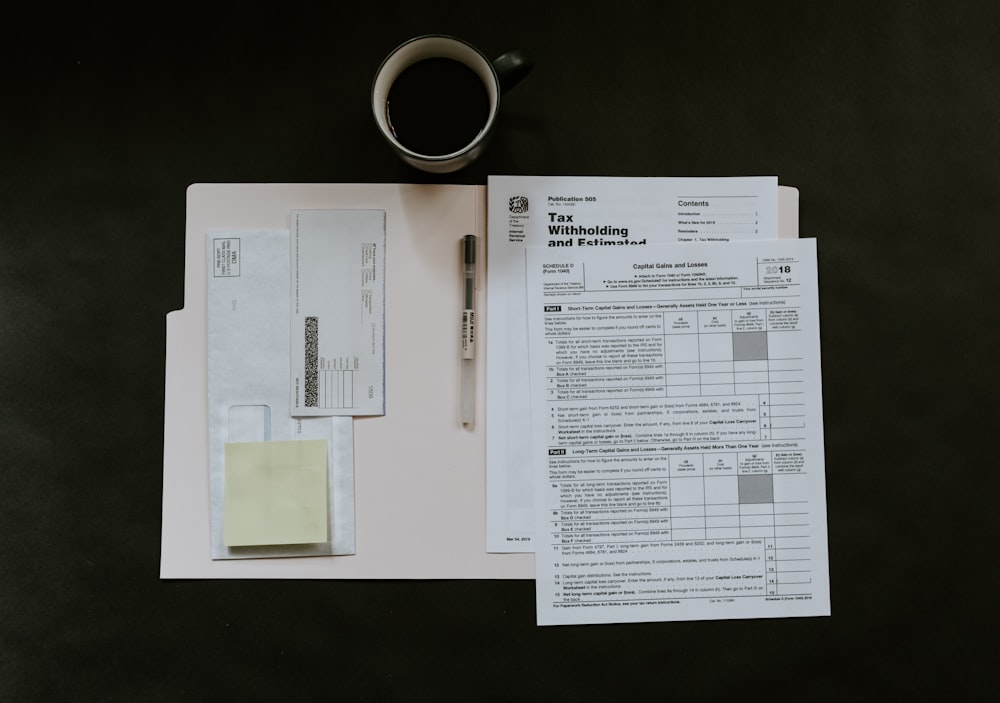

The tax system in Australia provides several deductions that people and corporations can claim to lower the amount of income that is subject to taxation. For taxpayers to maximise their financial circumstances, they need to have a solid understanding of the typical tax deductions in Australia.

In Australia, individuals can reduce their tax obligations by making lawful claims, which might range from deductions connected to investments to expenses related to their place of employment.

In this article, we will discuss a few of the more frequent tax deductions that are open to both people and corporations in Australia. Whether you are an employee, a sole proprietor, or the owner of a firm, knowing the typical deductions can assist you in navigating the intricate tax landscape and enabling you to make well-informed decisions to maximise your savings.

Let us look into the wide variety of deductions that might have a big impact on your annual tax return. These deductions range from the costs of your education to the contributions you make to charity organisations.

What Are The Average Tax Deductions In Australia?

There are several typical deductions that many Australians can use to lower their taxable income, though the exact deductions might vary depending on personal circumstances. An outline of common Australian tax deductions is provided below:

- Work-Related Expenses: Deductions for work-related expenses, such as uniforms, tools, and equipment necessary for your job. Costs associated with professional development and work-related education.

- Home Office Expenses: If you work from home, you may be eligible to claim a portion of your home office expenses, including utilities and internet costs.

- Motor Vehicle Expenses: Deductions for work-related car expenses, either based on actual costs or using the cents-per-kilometer method.

- Charitable Donations: Contributions to registered charities are generally tax-deductible.

- Investment Property Expenses: Deductions related to investment properties, such as mortgage interest, property management fees, and maintenance costs.

- Self-Education Expenses: Costs associated with education directly related to your current employment.

- Union and Professional Memberships: Membership fees for unions or professional associations that are relevant to your occupation.

- Tax Agent Fees: The fees are paid to a registered tax agent for preparing and lodging your tax return.

- Income Protection Insurance Premiums: Premiums paid for income protection insurance may be deductible.

- Tools and Equipment: If you are required to provide your tools or equipment for your job, you may be able to claim a deduction.

Please be aware that to qualify for these deductions, you must meet the requirements established by the Australian Taxation Office (ATO). The sums that can be claimed can also differ from person to person depending on their specific situation. To maximise your potential deductions while maintaining compliance with tax requirements, it is important to keep correct records and seek professional counsel.

To stay up-to-date on tax regulations, it’s recommended to either visit a tax professional for personalised guidance or check the latest changes from the ATO.

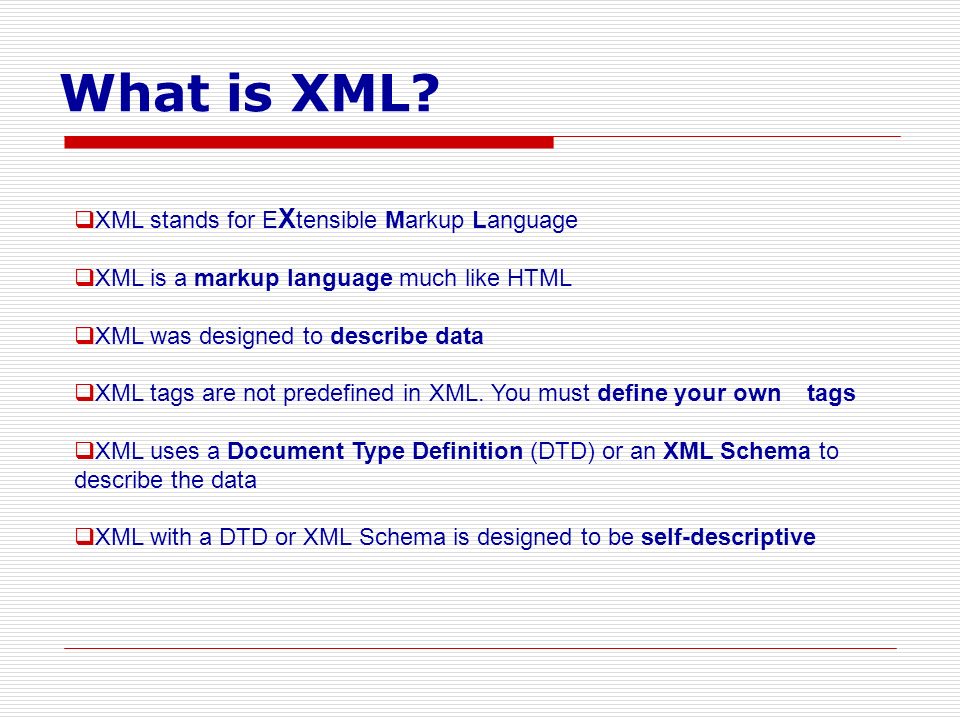

What Are The Three Golden Rules Of ATO?

In the world of cybersecurity and information technology, “Authorisation to Operate” is commonly abbreviated as ATO. Common names for the three guiding principles of ATO include the “Three ATO Pillars” and the “ATO Triad.”

When it comes to protecting and authorising a system’s operation, these pillars highlight different aspects. There are three essential guidelines:

- Confidentiality: Ensuring that sensitive information is protected from unauthorized access. This involves implementing measures such as encryption, access controls, and secure data handling practices to prevent unauthorized disclosure of information.

- Integrity: Ensuring the accuracy and reliability of data and systems. Measures are put in place to prevent unauthorized modifications, alterations, or tampering with data. This can involve the use of checksums, digital signatures, and access controls to maintain the integrity of the system.

- Availability: Ensuring that the system and its resources are available and accessible to authorized users when needed. This involves implementing measures to prevent and mitigate disruptions, such as denial-of-service attacks, and ensuring that the system can recover quickly from any downtime or failures.

The availability, confidentiality, and integrity of sensitive information are safeguarded by these three pillars, which together provide a thorough approach to security. Authorised systems must also be secure and dependable.

How Much Tax Is Deducted From Salary In Australia?

In Australia, a person’s income, residency status, and any relevant tax deductions or offsets determine the amount of tax withheld from their wage. Taxes in Australia are progressive, meaning that those with greater incomes are subject to higher rates of taxation.

The following tax rates are in effect for Australian residents as of the fiscal year 2021–2022.

- Income up to $18,200: Tax rate of 0%

- $18,201 – $45,000: Tax rate of 19%

- $45,001 – $120,000: Tax rate of 32.5%

- $120,001 – $180,000: Tax rate of 37%

- Over $180,001: Tax rate of 45%

Keep in mind that the Medicare Levy, a 2% additional tax on the majority of taxpayers that goes towards funding Australia’s healthcare system, is not included in these rates. Under some conditions, the Medicare Levy Surcharge may also apply to certain persons.

If an employee fills out a Tax File Number Declaration form and the Australian Taxation Office (ATO) provides tax tables, the employer can use those to figure out how much tax to deduct from wages.

For the most current information about income tax in Australia, it’s recommended to check the ATO website or speak with a tax expert, as both the laws and rates can change.

Conclusion

A thorough familiarity with essential concepts and rules is necessary for successful navigation of the Australian tax system. Honesty, integrity, record-keeping, and timely compliance are vital components of responsible taxpayers, according to the Australian Taxation Office (ATO).

Accurate record-keeping, timely lodgement and payment, and truthful reporting of income and expenditures are essential components of satisfying tax responsibilities.

Despite the lack of an official “three golden rules” from the ATO, the ideas described above perfectly capture what it means to be a responsible and compliant taxpayer. Businesses and individuals alike would do well to familiarise themselves with tax regulations, consult experts when necessary, and get in touch with the ATO if they run into trouble paying their bills.

Taxpayers can avoid or at least lessen the severity of penalties and other legal ramifications by strictly following these guidelines. Because tax rules are always changing, it’s crucial to keep up with the latest developments and adjust to new restrictions.

A just and effective tax system is beneficial to individuals and the community as a whole, and prudent tax practices help get us there.

To know more, click ato average deductions by occupation.